It seems like everyone knows that a financial collapse is coming. The only real question is when it’s going to get here. The Fed is working overtime trying to shore up the dollar, but that can only go on for so long; eventually, what they’re doing is going to catch up with us all and when it does, the fall will be even greater.

A financial collapse is much different than what most people imagine. It’s not a general breakdown in society and we don’t go back in time 150 years, living in the times of our great-great-grandparents. The two big signs of a financial collapse are high unemployment and runaway inflation. So, whatever preparations we make for the collapse, have to help us get through those two things.

I’ll have to say that there is no surefire way of avoiding being affected by the collapse. What you can do, however, is lessen the impact that the collapse will have on you and your family. You do this by trying to make sure that you are protected from the parts of the collapse which will have the greatest impact.

Your Job

To start with, make an honest evaluation of your job, looking to see how vulnerable it is to a financial collapse. Jobs that are involved in any way with luxury goods or services will be the first to go.

{adinserter usdeception}The most secure jobs will be those which supply essential services, followed by those that provide goods and services which people need to survive. Since people won’t be able to afford to buy new cars and appliances, repairing these types of items will be a very secure job as well.

If your job doesn’t look like it will be very secure in the event of a financial collapse, you might want to consider changing it, before it’s too late. Better to change it now, even with the bad job market, than to wait until you lose your job.

Another thing to consider is starting a sideline business, especially if it provides essential goods or services. Not only can that augment your income, but it will also provide you with something you can fall back on, if you lose your job when the collapse comes.

Your Debt

The next thing to take a look at is your debt. With prices skyrocketing due to high inflation, you’re likely to have trouble paying off your debt. This could lead to losing your car, furniture or home. The best way to solve that is to get out of debt before it’s too late.

I realize that’s a problem for most people, as the reason they have debt is that they spend more than they take in. The average American family lives on 110% of their income. However there are some things you can do.

If you are making car payments on two cars, like many families are doing, try and sell at least one of those cars and replace it with an older, but mechanically sound car, which you can buy for cash. That way, even if you lose the car you’re making payments on, you’ll still have one car.

You may want to consider downsizing your home as well, especially if you’re at the point of having an empty nest. Ideally, you’ll want to sell your house and buy one that you can pay cash for, out of the proceeds of the first house’s sale. Of course, few people will be able to do that. The better a deal you can get, and the lower payments you can get, the better.

Your Stockpile

It seems that pretty much everything is in short supply during a financial crash, especially the things you need to have in order to survive. More than anything, food becomes hard to get.

Stockpiling food can actually be seen as an investment, as inflation will hit food the hardest. You’ll be able to smile when you’re eating your $3.00 per box breakfast cereal, while everyone else is paying $12.00 for it.

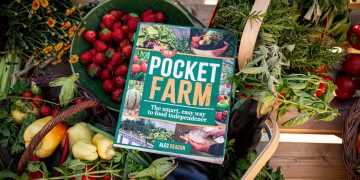

In addition to stockpiling food, it would be a good idea to start developing means of producing your own. It takes at least a year to get a vegetable garden producing well, so you don’t want to wait until the crisis hits to start your garden.

Start now, so that you can learn how to do it efficiently and build up good soil for growing your plants in. While you’re at it, take a look at growing chickens and fish as well, both of which are excellent sources of protein.

Besides food, you want to be sure that you have a descent stockpile of other necessities. Personal hygiene products may be a problem finding, as well as over-the-counter medicines. Don’t get carried away preparing for the zombie apocalypse, but make sure you’re ready with the basics.

Your Investments

There are probably a few people laughing at this heading, but that’s okay. Most of us have some sort of investments, even if we don’t think we do. Things like real jewelry (not costume) retirement accounts and stocks through our workplace are all investments, even if you don’t look at them that way.

Your best investment is getting out of debt. If you have $20,000 in a retirement account, you’re probably earning about 1% interest on it. At the same time, you might be paying 5% interest on your home. So, you’re losing money faster than you’re earning it. If you pay off your home, you have a net gain of 4.5%, even if you don’t have any money on hand.

The only investments that are secure during a financial collapse are precious metals and real estate. While it may be hard to sell either of them during the collapse, they are highly likely to retain their value or even appreciate in value. If you have other investments, you may want to consider selling them and moving the money into your home or into purchasing precious metals.

Before even considering investments, you want to make sure that you have enough food and other supplies on hand. Ultimately, they are a much better investment than anything, even gold. Not only that, they’re an investment which can help keep your family alive; gold can’t do that.

Here’s a somewhat risky strategy you may want to consider. Let’s say that you have $30,000 in investments right now, but you owe $100,000 on your home. Pulling that money out of your investments and putting it into your home may not be a good idea.

If you can’t make the payments on your home, after the collapse, you might lose it, along with the $30K extra you paid. But if you put that money into gold and silver, it will probably go up. The more the value of the dollar goes down, the more the value of the gold and silver will go up.

Once the gold and silver have appreciated enough in value, sell them and pay off your mortgage. That way, you own your home free and clear, so it can’t be taken from you.

Now, here’s the risk. I haven’t been able to find any documentation on it, but there’s supposedly a clause that allows banks and mortgage companies to reevaluate and adjust the value of your mortgage, in the case of a financial collapse. If that’s true and if that were to happen, you might not be able to pay off your mortgage using this strategy. Before trying to pay it off, check with your lender.

This article has been written by Bill White for Survivopedia.

If someone has savings or investments that would be able to pay off the debt, it might not be a good idea to pay it off until after hyperinflation hits. You could then pay it off with worthless dollars.

If you read the contract for your home, you will see a clause (among many) that let’s the bank refuse payments for varies and vague reasons. I promise you won’t be paying off the house during an economic crash. Also, If you own gold it will be outlawed and confiscated if found. You will also be unable to leave the country with your US Passport because they will shut the doors. I personally believe getting a legal 2nd passport and a bit of cash before crossing the border away from any checkpoints. No 2nd passport means NO GO. No cash NO GO.

Also, if you feel gold and silver are the answer to your problems and you want to purchase them regardless, purchase and hold outside of US and pay cash. Don’t store gold and silver in any financial institution. The fewer people who know you own the better. I think a few silver coins would be much safer to carry around. I truly believe the key to survival is leaving the US the day you suspect something big is going down and everyone is starting to freak-out. Once you arrive at your new location hopefully you would have stocked it with 20+ of every item needed to get through 20+ years of crap. Personal items and whiskey seem to be the best items to start stocking followed by female hygiene products because daddy won’t let his wife and daughters suffer regardless of the cost!

Recap, second passport and cash, a remote residence outside the US, silver then gold coins followed by stocking 20+ of the basics. If you have the money, everything times 200! Final comment, don’t keep anything in the US that you can’t walk away from at a moments notice. Don’t let a couple of family members cause everyone to stay. I know it’s heartless but the wife may have to leave her parents if she wants to live and she the kids grow.

I could be wrong about everything and hope I am. BTW, I’ve got seven dry runs and four routes for bugging out completed and everything works as planed.

What will happen to the uk

When dollar collapses.

Is it a good strategy to mortgage your house in the uk and buy a property outright in the east. Also is it wise to move cash to foreign account in east

If you are holding investments in gold stocks when the dollar collapses what would be the likely outcome?

That financial collapse clause is interesting. I’ve never heard of it but want to dig into in now. I can see bankers having a backup plan.

I am skeptical, if you have a “no prepayment penalty” mortgage than you can pay it off at any time.

I’m still laughing at ‘pay cash for the second car’ while living on 110% of income.

FIRST, they need to get rid of the stuff– like cable, hair salon visits, sculptured nails, expensive dine-outs, dry cleaning, movies out, vacations, new clothes every week!!!!!

Now, you may learn to live on your means, NOT above!!

I agree with you JayJay You are so right !

Regarding getting out of debt a good book to read is — “Meet Your Strawman: And Whatever You Want To Know” by David E. Robinson. — It is a small book which can be bought for a few dollars but well worth the read.

Justifications used to persuade Congress to pass the Federal Reserve Act of 1913 included preventing economic disturbances such as the prediction in this article.

Banksters decide when to ‘pull the trigger’–and we the sheep will mostly accept their dictates as to what the damages are and why we should continue to pay the banks. The game of creation of currency out of thin air is rigged. This game favors those who own the Congress and direct what agendas get funded with the newly created dollars (deficits).

We are free-range human beings surviving on the plantations (nations), and our fates are ‘chosen’ for us until we get wise and arrest the cabal of controllers. Do note what tribe has controlled the Federal (not) Reserve (none) for the past 30 years (or more).

We are conditioned not to criticize our controllers.

In the event of a dollar collapse, banks will be stuck. Sure, they may be able to repo your home, but not likely. View what happened when the mortgage debacle occurred. Banks were overwhelmed. People lived in their home for over a year w/o repo and then were permitted short sales. Why would a bank want your home when thousands of others are in default. Do not pay off your debts! In fact, it may be a good idea to use debt to buy survivalist material, guns, ammo, and food. If the dollar collapses, who will banks, credit companies send to repo anything? How will such people be paid? When financial disaster hits, it will be every person for him/herself. Best bet may be gold in 1/10th oz. coins and silver in 1 oz coins. Paper money will, of course, be paper, good for starting fires. Buy a few cases of decent booze and other non-perishables for barter. Toilet paper, aspirin, bandages, .22 ammo…think and you will figure out what will last and be good for barter.

I know when its going down Revelation 17vs we all know who she is don’t we

The strategy of holding Gold and hoping for an increase in value is flawed and here’s why:

If you own 1oz of gold purchased for $1000 in today’s money and the financial collapse takes place the dollar will devalue dramatically… lets say it halves in value… You can no longer buy 1oz for $1000… now you have to pay $2000…. the appearance is that the value of gold has skyrocketed.

As the owner of 1oz you may decide to sell the gold you bought for $1000 and now you have $2000 – but you have $2000 of a devalued currency that can still only buy the same goods and services as your original $1000 anyway.

Not only that but inflation will hit every other commodity that you might want to spend your $2000 on and in many cases the amplitude of this will be far greater than the % of currency devaluation (its not uncommon to see food and goods inflate by 100’s of % – look at Zimbabwe, USSR etc as examples – they actually print trillion dollar bills in zimbabwe… trillion dollar bills that are worth very little in real value)

Becoming self sustainable and investing in you ability to take care of your family through food production and health care is far more valuable than gold will ever be and if you do it well with some excess capacity for production you may even do very well by selling the excess to your neighbors for the gold that they bought and now realize is worth more paper money but actually holds no increased value at all.

You are incorrect! the value is what increases not the price. You assume 1000 of gold today means 2000 dollars of devalued dollar. price means nothing, Value is everything. Look at an asset you purchased 10 years ago and divide it by the price of Gold or silver or oil etc. Now do the same with the same asset which cost 1000 more and divide it by gold which went 600 % in price. You will see that the asset was overprices 10 years ago because you needed more ounces 10 years ago even while it was cheaper.your asset could be 1000% more in Hyper but you will need less ounces to purchase it.

Steve confuses the value (buying power) of precious metals pursuant to a dollar collapse with the value of a collapsed dollar. Forget the idea of converting anything of intrinsic value to pieces of paper. Convert gold to loaves of bread and other useful items. Gold or other items of value (coffee, liquor, medicine, food, ammo, etc.) will become the new currency. Returning to a fiat currency based on “faith” (as we have today) will be nearly impossible. Who would have faith in paper or cheap metal coins after a collapse?

StEve, “but you have $2000 of a devalued currency that can still only buy the same goods and services as your original $1000 anyway.” But if you have no gold your paper money goes to 0 and be no able to buy anything. Gold its going to preserve your purchasing power; do you get it?

That is what I was thinking. I also think that when thinking of the expense of a mortgage, the bulk of which goes toward interest in the first years, you still should consider that you have to live somewhere and so you are getting the value of whatever you would have paid in rent also. Additionally, you essentially control that property such that you could take in roommates and you get to take in increases in value over time when you sell (or of course you can borrow it from yourself via home equity line of credit which can be useful for large emergency but otherwise just knocks you back).

So those who say you shouldn’t pay off a mortgage may be correct in certain circumstances e.g. you have other money and therefore control the mortgage money at a very low rate allowing you to use your money to earn money elsewhere, but in general, owning outright is better because again it can be used as leverage and it reduces your expense for living somewhere.

Yes I know maintaining a property takes money and effort which makes me think of the argument about buying a new car because the old once becomes expensive due to repairs. I drive a 2004 vehicle and the maintenance (kept current) is nominal compared to owning a new vehicle (unless perhaps you can pay cash). Replacing a timing belt, battery, spark plugs, breaks, tires is not every year but is an expense at the time of repair – so what, make a small payment to yourself to cover the outlay when it arrives its not like you cannot predict when these things will be required.

What am I saying? That everyone’s circumstance is different and that you should consider all of the circumstances and specifics for your situation when making decisions e.g. pay down the house and maybe refi when you know darned well you income will be declining – this buys time to downsize (if necessary) or locks your living expense in to a manageable amount for the long run during which time you can reduce it further or let it all come out in the wash when you pass.

Do agree with stock up on non-perishables (or long-term food supplies) as costs can and do go up which will affect outlay of funds available.

Not on a fixed rate mortgage. Yes on an adjustable

But booze cigarettes and toilet paper commodities needed and can barter

My husband and I are retired and don’t have any debt. We put everything on our card but pay it off every month. But come the crash, his private retirement would cease coming and I’m assuming that so would my SS. How on earth would we use gold or silver when paper money is useless? I can see a lot more bartering and trading, but how do I take gold to the grocery store or courthouse to pay property taxes?

The “money” after paper money is exposed as worthless will be gold/silver coins, probably. Buy 1 ox. silver coins and 1/10th oz. gold coins is my suggestion. If your circumstances permit, store up lots of “essentials” that you can use as mediums of exchange. Decent booze, instant coffee, OTC drugs, kerosene…you think about what will be worth a lot when the manure hits the fan. Worrying about your debt is pointless if you have used your credit to buy essentials (food, clothing, shelter, water, a power source, an guns/ammo. If you used your credit to buy junk, you are in trouble because you have little credit left to buy things that will keep you fed, warm, etc. Survivalist stuff is way overpriced and a scam. Avoid it. Use you head and read on the net for stuff you will need, but do not buy from survivalist sites. When everyone is defaulting, your default is meaningless. Having loads of debt in a financial crisis is GOOD! not bad. The mortgage debacle proves this.

nope a new internal dollar will be imposed local dollar the actual dollar as world currency reserve will dissapear.we will use a new shit dollar.but the gold and silver will be used to purchase real estate etc because of the value.

Bottom line in my opinion is have less and own it the first three things, way to have income, owe nothing to no one, and stock things you need. Get every thing to be endependat for 30days then 90days then 6m then year use the investment you have to achieve this. Because hear is the thing either Jesus will return or the economy will eventually reset when that happens if you owe on everything if you did not lose it you will still owe and it will be harder to pay a days wages for a lofe bread is coming.

As I can see from the previous comments folks just don’t know what we’re in for. Acting like one will be able to save or hoard anything and live in a bubble while everyone is on the street of hades starving is wishful thinking at its best. There will be no new “normal”. Here we are in June of 2017 with people on the streets in every major city protesting about something or another on a daily basis. Many of these protests have become violent. This is during GOOD TIMES…!! Better find a cave, some dehydrated food, a gas mask and forget about Gold coins. Point is…..ENJOY TODAY….Just another day in paradise before all the cards fall.

Is Bitcoin or other currencies like this worth anything if the US currency crumbles. We are headed for darker days and I want to be better prepared. What do you do if you rent? I have no family.

Hey Kelly

I have the exact same question. I am in Australia, I rent I have pulled my Super down as per the current allowances and now want to know the best strategy for that money as if it will be worthless in the bank what should I invest it in now apart from stockpiling food water etc? what will happen to fuel I wonder as in for cars. I hope someone answers our questions here 🙂