Cash reserves are as necessary to survive in our modern world as beans, bullets or band-aids.

Many survivalists prophesy that cash won’t be any good in a disaster. I try to stay out of the business of predicting the future. Instead, I just try find fragility and root it out. If the past is any guide, cash has been supremely useful in most disasters, so it’s high on my list of “must-have” emergency preparations.

I use the term ‘cash’ loosely in this article. Consider it to refer not only to banknotes, but to any form of portable wealth that is easily portable and widely valued. “Cash is King!” is a phrased used to emphasize the importance of maintaining sufficient cash reserves. Unfortunately, the term is most often used when analyzing business or personal financial failures and keeping enough cash on hand is as relevant to survivalists as it is to finance.

I should point out that I’m not recommending that you covert all your investments to cash and store it in your bugout bag. What I am recommending is simply that you not put all your eggs in one basket.

Cash Can be Held in Your Possession

Money in bank accounts or investments may be impossible to access without electricity or access to the internet. If storage media is irretrievably damaged, accurate and timely records could be lost. If you can’t get at your money, it won’t do you any good. Cash doesn’t have these drawbacks.

Cash is Portable

$100,000 in $100 bills is about the size of a large book. Needing to hide a lot of wealth in a small space is a good problem to have, as problems go. If you’re lucky enough to have this problem, you might consider 500 Euro banknotes, gold or similar forms of portable wealth.

Cash is Liquid

To spend precious metals, they must first be exchanged for cash at a bullion exchange. Accessing bank accounts or investments without electricity or the internet may be impossible.

Most people entrust nearly all their wealth to bank accounts, CDs and certain types of retirement accounts that are FDIC insured. For most types of accounts, this insurance has been reduced to a maximum of $100,000 per account, per bank and stocks, bonds, annuities, mutual funds and many other types of investments are not covered at all.

Unless you own your home outright, if you miss a payment, you set the eviction process in motion. If you live in an apartment, do not expect your landlord or the bank to take pity on you if the banking system goes down. With sufficient cash reserves, you can keep making payments if the banking system goes down.

Unfortunately, even if you own your home, you don’t really own your home. Miss a property tax payment and you set a process in motion that allows the government to sell your home to recoup the unpaid taxes.

One solution is to set cash aside cash to pay your rent, mortgage or property taxes in case you lose your source of income. When allowed, sometimes the better option is to prepay. Prepaying future expenses that you will almost certainly have to pay anyway also protects you in the event of hyperinflation, which could drive up the price of housing, but not if you have already prepaid.

When calculating how much cash you need on hand, consider mortgages, leases and zoning laws. You may be required to pay for power, gas, parking and other services to keep your residence, even if you don’t use those services or they are on again, off again. If sheltering in place is figures into your plans, you had better have cash reserves.

Major Disasters

In my line of work, I get to talk to a lot of survivors and a Hurricane Katrina survivor I spoke with was a good example of the need for cash in emergencies. His household was more prepared than most. In particular, he had a generator. Because his generator was the sole source of electricity for their family, and eventually for all the neighbors who could hear it running, he ended up running more than he planned. As time went by, gas usage increased, gas became harder to find and gas prices soared. When gas could be found, lines were long and vendors only accepted cash.

Since his generator ran on unleaded instead of propane, it cost upwards of $400/week to feed it. One week turned into two, and then two weeks turned into four, and they had not planned on an extra $1,600 per month above and beyond what they spent on hotel rooms and travel expenses to house family members who had evacuated, and nobody was getting paid. In serious disasters, money becomes very useful, while bank cards often become useless.

Stability to Face an Uncertain Future

With few exceptions, disasters and emergencies cannot be predicted. If we could predict them, they wouldn’t be emergencies. They’d just be one more thing to plan for, like a house payment or saving for college. Because we can’t predict them, emergencies seem to materialize out of the blue and our best plans often fall short. Cash reserves give you the time and resources to respond to volatility whether it takes the form of job loss, a large-scale disaster or some threat you haven’t even considered yet.

Deflation

Inflation and hyperinflation are not the only risks. In deflation, investments in the stock market lose value and banks go bust. Cash reserves ensure that you can weather the storm because, while investments like stocks and bonds will lose money, the value of cash will increase. This increase can help offset your losses if you possess enough cash.

Minor Emergencies

Small fires, medical emergencies, loss of employment, car accidents, robberies, vehicle theft, home invasions, vandalism, identity theft … these events result from the low order volatility that is life’s soundtrack. Lesser ups and downs happen all the time, so be ready for them.

Supply Your Own Credit

Cash in reserve means you do not need to use credit and do not miss payments, which means no interest, NSF charges, late fees or penalties. I have not used a credit card in almost fifteen years now. I also haven’t paid a dime of interest. People who understand interest collect it. Those who don’t, pay it.

Privacy

Privacy has become mighty expensive for a human right. The costs of separating your mailing address from your residence address, separating your name from your vehicle registration and license plates, buying burner phones and other privacy tools can really add up. Survivalists wanting to maintain personal, group or operations security would be well advised to save up a few thousand dollars in cash before attempting to drop off the radar because it can get expensive.

The first step to making yourself hard to find is to move and sell any vehicles. You’ll need a ghost address or two, mail forwarding, PO Boxes, some computer and phone hardware and you’ll probably have to set up a few LLC’s. You’ll also want to stop using credit. Each of these steps costs a little money up front, but not using credit is likely to save the average American more than they’ll spend on the whole shooting match.

Self-Recovery

Always carry money, even in the wilderness, because you’re not planning to stay there forever. When you do make your way back to civilization, you’ll need cash. Should you make it out of the wilderness under your own power, you can buy food and a drink and go to a hotel or go home. Otherwise, you’ll be a refugee or a victim staying in a shelter if you’re lucky.

Because self-recovery takes money, cash, local currency, gold coins and gold rings are sometimes issued to military personnel who operate in or fly over enemy territory. It’s cheaper and puts fewer lives at risk than a rescue mission.

Cash Makes it Possible to Invest

Investors play the long game. Without enough cash in reserve, you can be pressured to sell at the worst possible moment. Buying low and selling high is easier said than done when your investments tank and you do not have sufficient cash reserves to weather the storm. Without those cash reserves, you may be forced to sell low just to pay your bills.

Money is Multi-Use

Effective survival planning and equipment must be versatile, adaptable and multiuse and few pieces of survival equipment are as multiuse as money. Properly used, it is hard to equal the utility of cash anyplace you deal with other people.

Although operatives do not normally carry firearms on foreign soil, they do carry money. They can lay hands on firearms, when necessary, but carrying a firearm in a foreign country can create more problems than it solves. They don’t just dole out money to make people like them, but it’s easier to like someone who is generous, and pays their own way. Keeping commitments, especially financial commitments, is the key to building relationships of trust.

Don’t Put All Your Eggs in the Same Basket

How often do monetary systems collapse? It depends what part of the world you live in, but even in most of Africa and South America, most people still do business in the local currency most of the time.

I do not advocate keeping all your assets in cash. That would be putting all your eggs in one basket. I don’t advocate putting all of your money in the bank. The safest strategy is to diversify. Leave some money in the bank, invest some, put some in precious metals, put some in local currency and some in a stable foreign currency. Invest some in hard assets like food storage and other survival stores. Just don’t store them all under the same roof.

If someone tells you to put all your money into any one place, I would view that advice with a healthy dose of suspicion.

Detachment

It may be because you house is on fire or due to some other disaster or due to a threat to your security, but independent of the “why”, some day you may need to walk out the door and never come back. If that day ever comes, having sufficient cash reserves tucked away gives you the option to walk away.

Survival Uses for Cash

- Use a pay phone – Cell towers are often overloaded during emergencies but pay phones use land lines, which are a completely different system that sees comparatively less use due to the popularity of cell phones. Carry lists of pay phones for areas where you spend time.

- Transportation – Use cash to take a taxi or a bus if they are functioning.

- Social Engineering – Getting people to do what you want is easier when you have money to obtain needed resources.

- Communicate without being Tracked – Use cash to buy a burner phone and an airtime card.

- Air up a tire – Every driver has needed to air up a tire at some point and only been able to find places that require quarters.

- Pay for internet access at an internet café – Believe it or not, there are still airports without WiFi. I found one while I was in a rush to buy a ticket online so I wouldn’t have to pay an arm and a leg.

- Rent a Room – It’s harder to make money when you are living out of a backpack in a campsite and chances are that you’ll need to make some money at some point.

- Last Minute Purchases – There are some things that may be difficult to stock up on, like certain prescription medications. Even the most prepared of folks might benefit from a few “last minute purchases.”

- Last Minute Purchases – Some things are tough to stock up on, such as prescription medications. Even the most prepared of folks would probably benefit from a few “last minute purchases” when disaster strikes.

- Car Parts or Repairs – Finding parts or repairs can be difficult off the beaten path. I have run into folks on backroads trying to bargain combinations of cash and property for a full-size spare tire or something else they needed. Most of the time, they end up having to offer a whole lot more in even a partial barter than they would have in cash, so be sure to bring enough cash that don’t wind up trying to scalp deer tags on the side of the road due to a blowout.

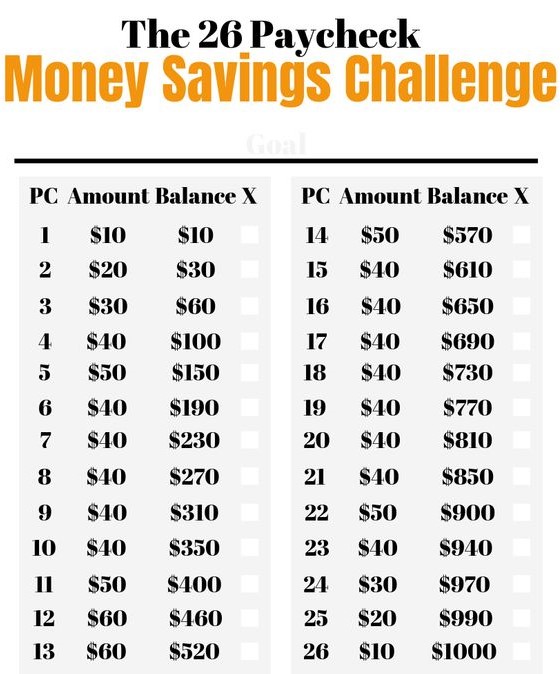

How to Start Saving Cash

I did this and am a much happier person for it. Give it a try and you’ll get out of debt and have more discretionary income to invest in becoming more self-reliant.

- Visualize Why it’s Important to Save Cash – Before you start, visualize your reasons for wanting to do this. People think they fail due to lack of willpower, but that’s not why they fail. They fail because they don’t sufficiently commit themselves to their cause. One your vision changes, your attitudes and behaviors will naturally fall in line because they are functions of vision.

- Save Enough to Pay Your Expenses for a Month – Have a month’s expenses on hand gives you 30-days to create a plan and then act on it. Once you have a month of reserves on hand, then go for two, then three and so on.

- Stop Using Credit – When I was a young man, if I wanted something, I had to set to work and save up enough money to buy it. Today, credit offers a quick fix, enabling young people right out of college to buy everything their parents accumulated over a lifetime of hard work. The truth is that they don’t need it, they just want it. They swipe their plastic and start making payments, much of which is interest. The solution is to stop using credit.

Not using saves big money in interest and pays dividends in increased privacy. You can even pre-pay rent. When you prepay, you aren’t asking the vendor, bank or landlord to loan you money, so there is a whole lot less paperwork, which protects your privacy. So, pay cash.

The other side of not using credit is to stop buying things you don’t really need. Most people pay for all sorts of things they don’t really need. If you’re in debt, cut out everything you don’t absolutely need and use debt stacking to get out of debt. That means no cable TV, no new clothes, cancel all your subscriptions, cut deep. In the end, Diversify Your Cash Reserves – If all the cash you have on hand is in US bank notes, you could be hard hit if the dollar loses much of its value. Splitting those reserves between more than one currency and precious metals ensures that you won’t lose everything if the dollar takes a hit.

A way of saving cash money that actually works to only keep no more than five one-dollar bills in your wallet. When you have more than that, set them aside in a drawer. You will be surprised how quickly they add up. Periodically I will bundle them into packs of 50 that go in the safe. My wife was shocked when we had a need for the money and I pulled out over $1600 in $1 bills that we took to the credit union. We have expanded this to doin the same with $5 and $10 bills and when our furnace died, were able to pay for a new one without a problem. Of course, it helps to periodically take some in to a bank or credit union and trade them in for $20 bills, but put those back in the safe. We had a situation a couple of years ago where power was out in the area for several weeks, we were just fine insofar as purchasing power. We still have bank accounts and credit cards, but try to keep a good supply of cash on hand. Doing it with the $1 bills makes it close to painless. The $5 and 10 bills less so.

I’ve never been in SHTF situation. But I have been in Ouray, Colorado, passing through and stopped at a restaurant, when data service for the whole area was down. They could only accept cash. Fortunately, I always try to carry enough cash on me, and I’m in the habit of using cash most of the time, so it wasn’t a problem for me.

But I do know people that are in the habit of carrying little to no cash, instead relying on a debit card. Although this is fine in a huge majority of situations, it’s not the best idea.

Quarters to air up a tire? 12 volt compressors which run off the cigarette lighter are under $20 (under $10 at Harbor Freight). They are slow but will get the job done and will save you plenty of quarters in the long run.

Not to mention that if SHTF, there may not be electricity at stores in the area. I carry a compressor in each vehicle. I don’t buy the cheap ones like you mentioned, however, as I’ve had them go bad, and they take too long to inflate.

Back about 20 years ago, I bought a better quality compressor that has more flow (I think it’s called Interdynamics Truck Air?), and I still have it. It still takes a little time to inflate, but can fill a tire in about half or a third of the time one of the smaller, cheaper compressors takes. And my other vehicle has one sold under the Slime brand name (as in the tire sealant brand), that’s well built and also inflates pretty fast.

Yes, I have no problem paying more for a compressor that inflates faster and lasts longer.

On payday, take all of the cash out of your wallet and put it in your stash. I especially favor ones. You don’t want to get to the front of the line and only have a $20 and be told, “We don’t have change.”

The burner phone is a good idea but be careful where when and where you use it and who you call. Even though the NSA can’t record your calls they track locations and link the calls and locations. If you call from home it is linked to your address and other phones at that address. Calls to friends or family, more links etc. I recommend storing it W/O the battery or in a metal container. If they get curious they can ping it for location or even turn it on to listen in etc. So, carry safely to a public place and then make call.